India's Semiconductor Mission

- 10 minsThe 21st century is widely regarded as the digital age, marked by continuous leaps and bounds in various domains such as technology, healthcare, alternative energy, social networking, and scientific discoveries, with each passing year.

This monumental growth can be attributed to the ability to perform complex computations on the large amount of data that we are able to collect and store, which is enabled via semiconductor chips.

What is a Semiconductor Chip?

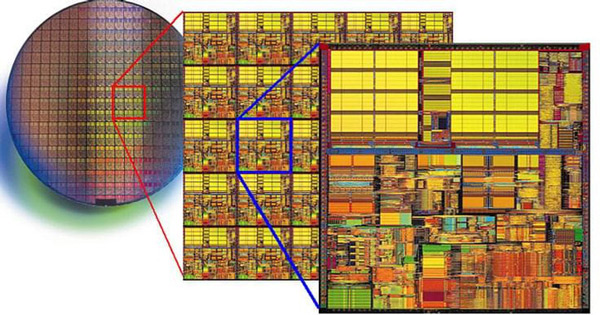

A semiconductor is a material typically composed of silicon, exhibiting conductivity greater than an insulator like glass, yet less than that of a pure conductor such as copper. Their conductivity and other properties can be altered with the introduction of impurities.

A semiconductor chip can consist of more than 1 billion nanometre sized semiconductor switches, called transistors which are the driving force behind the operations that software programs are built on. These chips play a crucial part in the functioning of all modern electronics and information and communications technology products.

Introduction

Why are Chips that Important though?

The modern political international landscape is complex, where a nation’s strength is now predominantly reliant on its economy rather than its weaponry. A stronger, larger and more stable economy can exert a greater influence on the international stage. Inside the country, we also witness better standards of living, reduction in poverty, lower unemployment, longer lifespan, increased per capita income etc.

Combining the above facts, where semiconductor chips form the core of 21st century technology and that the strength of a nation’s economy is vital to its survival, we begin to realize how important the ability to manufacture semiconductor chips becomes.

The two largest economies, being US and China have significant capability in the field of semiconductor manufacturing. Semiconductors may contribute to only a small percentage of global GDP, but they power trillions of dollars of goods and processes.

India’s Plan on Semiconductors

In pursuit of a vision of Atmanirbhar Bharat, India is seeking foreign investments for its indigenous semiconductor industry for the development and design of fabs, ATMP (Assembly, Testing, Marking and Packaging), among others. India’s dream of becoming a hub for making computer chips is finally moving in the right direction. This is really important for India’s growth in industries and keeping our digital independence. It also helps India be a big part of the worldwide electronics and computer chip industry.

The vision of Atmanirbhar Bharat in electronics & semiconductors was given further momentum by the Union Cabinet, chaired by the Hon’ble Prime Minister, approving the Semicon India programme with a total outlay of INR 76,000 crore for the development of semiconductor and display manufacturing ecosystem in our country. This will serve to pave the way for India’s growing presence in the global electronics value chains.

The Modern-Era Cold War

In the contemporary world, power is built on a foundation of computer chips, influencing military, economic, and geopolitical dynamics. The United States has maintained its superpower status by leading advancements in computer chip technology. However, the US’s dominance in this area is facing challenges due to the assumption that globalizing chip manufacturing by including its allies like Taiwan, Korea and Europe, benefits American interests.

China is investing heavily in its own chip production to catch up, and this competition for control over the industry has significant implications for the future. China spends more money importing chips than buying oil, and they are China’s greatest external vulnerability as they are fundamentally reliant on foreign chips. But with 37% of the global supply of chips being made in Taiwan, within easy range of Chinese missiles, the West’s fear is that a solution may be close at hand.

As the next decade heads towards an era of Artificial Intelligence, both the US and China find themselves lacking a distinct edge in data and algorithms. This brings computing power into the spotlight, where the US is clearly ahead right now. But with China’s persistence in playing catch-up and US losing its innovative edge, the inevitability of the Taiwan conflict comes into focus.

The competition for chips will only intensify and time will only tell who wins.

India’s Present State

Design vs Manufacturing

India hosts major global semiconductor design firms, with R&D centres established here due to a sizable talent pool, constituting up to 20% of the world’s semiconductor design engineers, and a substantial number of registered design patents/IPs. While India excels in chip design and related technical services, it lacks fabrication facilities due to the substantial investments required.

“A fabrication facility for chip manufacturing requires on an average $8-10 billion of investment. Very few private investors are willing to invest that much money as they first have to see the commercial viability of such a project. Most chip designers outsource to third-party manufacturers who have the expertise and scale in developing such chips,” says Dr Satya Gupta, Chairman of India Electronics and Semiconductor Association (IESA) .

China and Taiwan have cultivated robust ecosystems with extensive government backing, encompassing materials, machinery, manufacturing, testing, packaging, and sales. However, India’s ecosystem is not yet on par, primarily due to scale and investment challenges.

What it takes to build a Semiconductor Fab?

Recognizing the substantial demand, quickly scaling up chip manufacturing is challenging due to the time needed to establish chip foundries. This process is complex, costly, and time-intensive. As highlighted in a Bloomberg Quint report, chip production generally spans over three months, involving expansive factories, controlled environments, high-value equipment, molten tin, and laser technologies.

Numerous factors require consideration, for example procuring lithography tools from international suppliers, establishing proper infrastructure including extensive land, ample water supply, water recycling systems, electricity connections, and a capable workforce. The equipment costs alone can reach up to $2 billion. Additionally, setting up a fabrication facility requires infrastructure expenses ranging from $200 million to $300 million. Moreover, companies providing lithographic tools to fabrication plants may impose technology transfer fees.

Case Study - Semiconductor Complex Limited

Overview

During the 1980s, the Indian government tried to follow countries like China, Taiwan, Malaysia, Korea, and Singapore in establishing their own national leader in semiconductor manufacturing.

SCL was established to fulfill India’s aspirations of creating a semiconductor manufacturing sector. The Indian Government sanctioned the formation of SCL in 1976, and its production commenced in 1984. SCL’s mission was to design and produce advanced circuits and electronics, laying the groundwork for a self-sustaining Indian electronics industry.

Progress at SCL

SCL had achieved significant milestones in its journey towards becoming a global semiconductor manufacturer. Despite being a state-owned enterprise, SCL managed to make impressive progress and was considered just one node (relates to size of a transistor) behind the rest of the world in semiconductor technology during the early 1980s. To highlight the importance of this fact, TSMC reported 27% of its revenue from the 7nm node in 2019. At the same time, the 16nm node, which was 2 nodes behind 7nm, reported 21.7% of total revenue. The takeaway is that production of n - 1 or even n - 2 nodes has a significant market share as devices are slow to adapt to the next generation chips.

SCL was India’s only major semiconductor manufacturing company. It had a production line capable of manufacturing 64K dynamic random-access memory (DRAM) chips, and it was planning to expand its production capacity to meet the growing demand for semiconductors in India. SCL was also involved in research and development, and it was working on developing more advanced semiconductor technologies. It had a number of partnerships with foreign companies, and it was hoping to attract more foreign investment.

Fire at SCL

SCL’s ambitious plans came to a halt on February 7th 1989, when a mysterious fire in the complex let to the destruction of its production line. The fire also damaged India’s semiconductor industry as a whole, and it took many years for India to regain its position as a player in the global semiconductor market.

The report had the following findings:

- The SCL employees’ union felt the fire could not be controlled due to mismanagement besides lack of initiative on the part of CISF (Central Industrial Security Force) unit

- The panel headed by the retired Major General of the Defence Fire Research Institute blamed the management for its failure to control the fire

- The panel ruled out the possibility of any external sabotage and said the fire could be the result of an accident or short circuit

- It found serious lapses in the firefighting arrangements at the complexes, which were completely engulfed in fire

Aftermath

Following the devastating fire, there were assurances from the government that SCL would soon return to production. The then Minister of State for Science & Technology, KR Narayanan, promised to introduce new technology and ensured no retrenchment of employees. Nevertheless, despite these assurances, the facility faced a meticulous eight-year journey to resume operations in 1997.

The delay in resuming operations took a toll on SCL’s progress, and the government’s attempts to sell a part of its equity in 2000 were unsuccessful due to disagreements with potential private investors over terms. Delays in decision-making by successive governments also contributed to the hindrance of India’s semiconductor dreams.

If the Fire hadn’t Occurred

If the fire incident at SCL had not occurred, India’s semiconductor industry would likely be more advanced today. SCL was a top producer of DRAM chips back then, with the potential to become a major player globally.

Without the fire, SCL could have continued expanding its manufacturing abilities and product range. This would have attracted more investment in India’s semiconductor industry, thus creating more job opportunities.

Moreover, India could have become less reliant on imported semiconductors, strengthening its economy against external disruptions and boosting its manufacturing sector.

India Semiconductor Mission

In September 2022, the Ministry of Electronics & Information Technology (MeitY) introduced a new semiconductor policy to foster investments in semiconductor and display fabrication in India. The program offers enhanced incentives, including an outlay of ₹76,000 crores ($10 billion), with the government providing eligible applicants 50% financial support.

The incentives extend to various semiconductor units like compound semiconductors, silicon photonics, sensors (including MEMS), and ATMP/OSAT units, with a target of establishing 20 such units under the scheme.

In addition to the central government support, state-sponsored initiatives like Gujarat’s, provide further assistance, reducing investors’ required capital expenditure and increasing their stake in production.

Conclusion

Foreign investment in the chip manufacturing sector is still in its deliberation stage, the reason being India is yet to prove itself as a fertile ground for semiconductor manufacturing. But, once the machine gets running, we can expect India to be a hub for large scale chip manufacturing industries and consumer electronics.

We will have to learn from our past mistakes and recognize the importance of process safety while dealing with this complex industry. Compromising here, can lead to huge losses that we have already witnessed in the past.

Speaking about the road ahead for India and its semiconductor ambitions, India can have lofty ambitions for the future but at present taking the first step and setting up a robust ecosystem is key.